Verify Identity

Reuse Identity

The financial identity that moves and grows with you.

Get a Portabl ID

Dive in deeper to understand ID verification & security with Portabl.

We're building the future of identity.

The Portabl Network

Open banking needs reusable identity that is user-controlled and is based on networks of trusted issuers and verifiers. We’re powering the future of consumer data control and one-click experiences with next-gen standards that fit with your KYC and AML policies.

In an era of complex fraud and smart bots, generating and verifying portable credentials with privacy-preservation intact is becoming one of the most significant competitive differentiators.

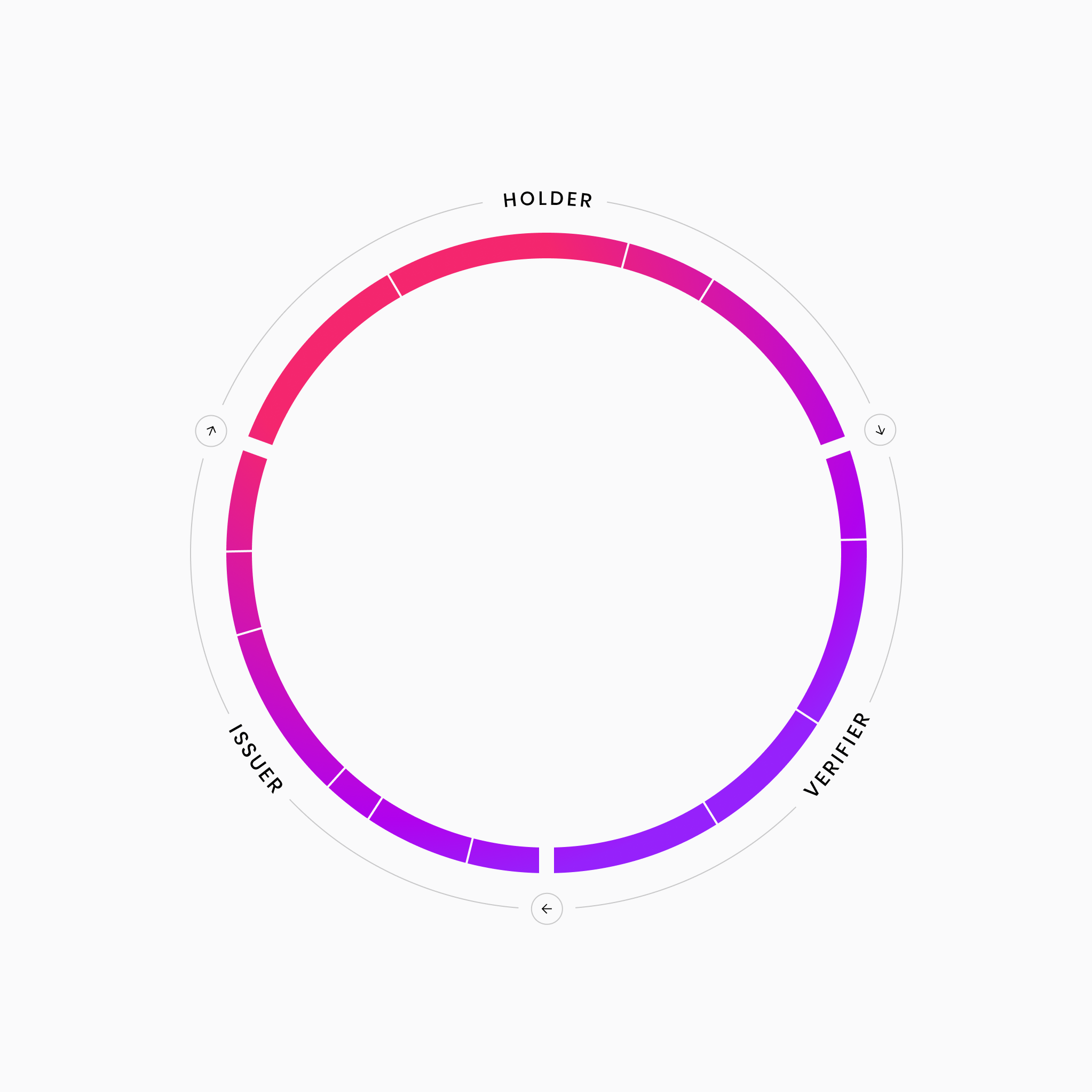

Issuer — Issuers are apps and providers that are authorized to issue credentials. Issuers authenticate specific data on behalf of their users, sign it with keys, and empower their users with a reusable data format, like a stamp in a passport.

Holder — Holders own credentials and have control over how they’re managed, shared, updated, and revoked. In the Portabl ecosystem, holders are consumers. Holders can present credentials to verifiers on-demand for specific purposes — user authentication, data validation, signups, etc.

Verifier — Verifiers are apps and providers that verify and consume credential information when presented by a holder. Verifiers ensure that credentials are valid and conform to their business requirements and policies.

We build trusted networks of known users.

User-controlled verifiable credentials can be shared on-demand and are secured by cryptographic verifiability. Consumers are able to build secure reputation and trust that travels; businesses gain added protection from identity forgery, replay attacks, and takeover fraud.

The relationship between providers and consumers is often called the ‘trust triangle.’ This describes the relationship between consumers (holders), and businesses in the network that issue and verify user credentials. The key concept is that trust in the holder travels because their associated information is “vouched for” by trusted parties in the network and credential activity flows through the holder. Issuers and verifiers sign data using their own private keys, in effect adding a stamp of authenticity to data, metadata, and documents that can be reverified downstream.

In order to build a future in which claims about a user’s identity are self-controlled and reusable between and among providers, we wrap the best of traditional ID proofing and biometrics in reusable, secure, and user-permissioned format using verifiable credentials (VCs), decentralized identifiers (DIDs) and public-key infrastructure (PKI).

This lets Portabl become the first open finance identity platform that specifically uses decentralized identity technology to marry reusable KYC with strong authentication as a platform for new user experiences.

We power flexible tap-to-prove experiences anywhere in the lifecycle.

A Thomson Reuters survey of banking customers found that 89% did not have a good KYC experience, and 13% changed their financial institution as a result.

Portabl combines verifiable data and verifiable processes with user control to make any type of identity disclosure simple and consistent anywhere in the customer lifecycle while satisfying governance and provenance requirements of modern AML programs.

60%

60% of all users abandon signing up for accounts because of process friction

87%

87% of people are neutral or dissatisfied by the way their data is handled online

94%

94% of respondents to our own surveys would be happier with an app or service that had reusable identity experiences

We enable businesses to empower consumers with their own data.

We are combining reusable identity and trust networks with a few more user-facing super powers that enable people to self-aggregate their data and reduce their identity sprawl and fragmentation. This is the Portabl passport— a single HQ for individuals to manage their trusted information and linked accounts.

Issuing identity credentials back to their users enables providers to benefit from dynamic updates and continuous identity with lower overall PII risks. Safer exchanges with high-trust data unlock a more durable relationship between consumers and their trusted providers.

Becoming a trusted ID issuer provides a direct path to higher user engagement and NPS: credentials can be used to unlock new types of bundling and affiliate opportunities, resulting in greater flexibility, access, and retention.